[supportcandy]

The Tax Attorney for Tax Professionals

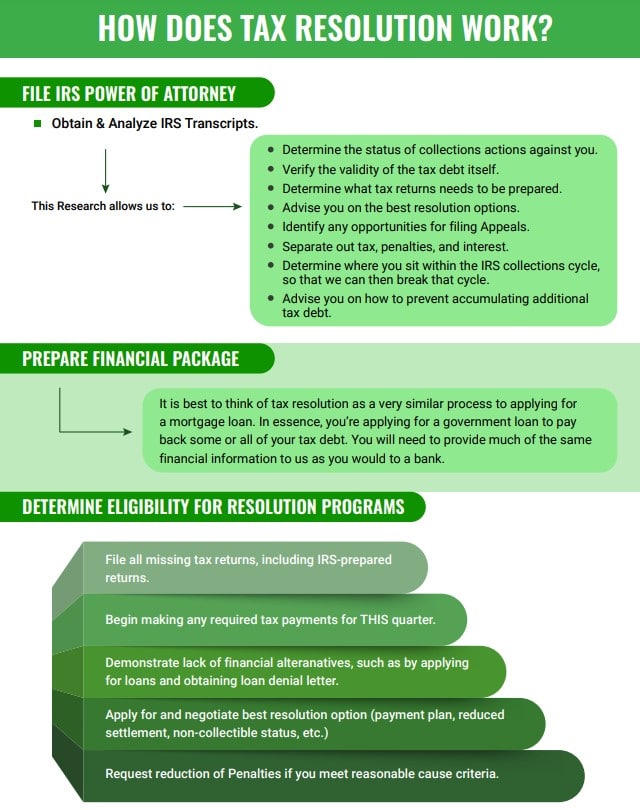

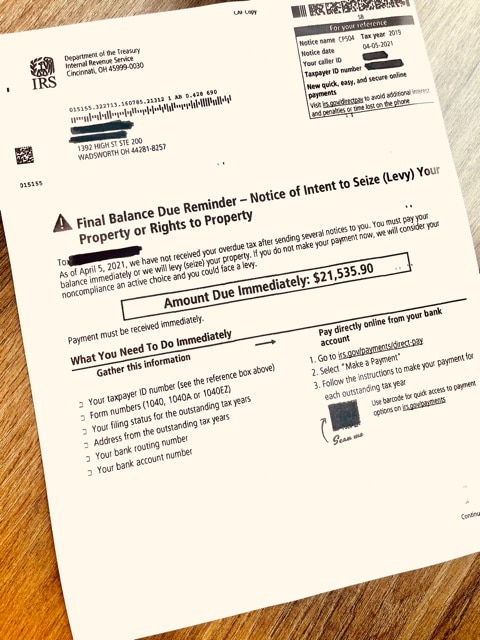

Finally. Someone did it. A one-stop shop for tax professionals to get their tax law questions answered and to have a trusted source to refer tax resolution and tax audit clients. Tax attorney Joshua Sells realized a void existed for tax return preparers. The return preparers were very good at creating an accurate filing and answering their clients’ tax questions. Still, many did not know how to advise their clients if there was a huge tax due that the client could not pay. Josh started the J. M. Sells Law Tax Attorney for Tax Professionals program with this in mind!

Simply use the tax resolution referral widget below to submit a ticket to Josh to review your client’s situation or ask a tax law question. Josh will review your client’s case and help your client understand their options for programs like a tax settlement. J. M. Sells Law will also give your client a significant discount code just for being associated with you – their tax return preparer.

IRS Tax Attorney Joshua Sells

- Senior Tax Attorney at J. M. Sells Law, Ltd.

- Admitted to the OH Bar, U.S. Tax Court, and Licensed before the IRS

- J. D. from Case Western Reserve & LL.M. (Taxation) from Georgetown

- 20+ Years Experience, including with Big4 Accounting Firms Deloitte & PwC

Sign in and Create a Ticket to Submit Your Request

- Send us your tax law questions - no charge or obligation to you - we're glad to help

- Have a client with a large tax balance? Refer them and they receive a significant referral discount

- They remain your clients - we never "poach" tax return clients - we focus only on tax resolution & audit

- When we have clients that need tax returns in your geographical area, we'll send them your way